Tuesday, November 25, 2008

New ProFunds Hit the Market

ProFunds has launched 12 new leveraged mutual funds, including commodities and currencies (Euro & Yen).

A New Fund to Keep My Eye on

The Dover Long Short Sector Fund (DLSAX). High turnover and 1.75% expense ratio but it seems to be holding up with a basically flat return for the year.

We are creating a couple more model portfolios for our subscribers next year, one of which is a Long Short Sector Rotation Model. I wonder how our model will perform compared to this fund. At the very least it could provide a benchmark for the new model.

We are also looking into creating a Long Short Country Rotation Model and a Commodity Trading Model (CTA), similar to a manged futures hedge fund.

We are creating a couple more model portfolios for our subscribers next year, one of which is a Long Short Sector Rotation Model. I wonder how our model will perform compared to this fund. At the very least it could provide a benchmark for the new model.

We are also looking into creating a Long Short Country Rotation Model and a Commodity Trading Model (CTA), similar to a manged futures hedge fund.

Monday, November 24, 2008

Hedged Mutual Funds

Richard Widows at The Street details a few mutual funds with hedge fund strategies. We have our eye on all of them. Hopefully, more and more of these funds will become available as long as there are good managers running the ship.

Another Bailout. Who's Next

Oy...Here we go again. But at least the markets up two days in a row.

Wondering if Citigroup got the automaker's money?

Unfortunately, we don't know if these bailouts will even work.

Wondering if Citigroup got the automaker's money?

Unfortunately, we don't know if these bailouts will even work.

Hedge Funds Lost a Little Money Last Month

$40 Billion. Ouch.

Performance hasn't been great. Our portfolio strategies are greatly performing the hedge fund indexes. I'd be curious to see who the top performers are on a regular basis.

Performance hasn't been great. Our portfolio strategies are greatly performing the hedge fund indexes. I'd be curious to see who the top performers are on a regular basis.

Monday, November 17, 2008

New Buffet Moves

In the most recent quarter, Buffet made a few under the radar moves. He bought Eaton (ETN), added to his stake in ConocoPhillips (COP), U.S. Bancorp (USB) and NRG Energy (NRG), while trimming CarMax (KMX), Bank of America (BAC), Lowes (LOW), and Home Depot (HD).

New Putnam Strategy

Putnam is straying from quantitative investing and moving into more fundamental strategies in an effort to combat poor performance.

I can't see why they can't just use both. I have done extensive research on quantitative investment models and if done correctly, they can be quite profitable. Even the fundamental portfolios I track are quantitative in nature.

I can't see why they can't just use both. I have done extensive research on quantitative investment models and if done correctly, they can be quite profitable. Even the fundamental portfolios I track are quantitative in nature.

Farrell Thinking Depression

Will we be heading into the next great depression? Paul Farrell thinks so.

Cuban and The SEC

Looks like the Cuban has a little more on his plate. Probably doesn't bode well for his interest in the Cubs.

Monday, November 10, 2008

Astrology as an Investment Strategy

Arch Crawford uses planetary cycles to dictate his investment philosophy. He is doing quite well I might add.

What's next clairvoyance?

What's next clairvoyance?

Hedge Fund Replication

All About Alpha had a good post about Hedge Fund replication strategies missing factors. I was never a big fan of hedge fund replication strategies. I just don't see the point in investing in a hedge fund index when their returns tend to have a high correlation to the market anyway. You could do better following your own alternative strategy as our model portfolios are beating the pants off some well known hedge fund indexes.

Tuesday, November 4, 2008

ETFs With Even More Leverage

Here we go. As the financial system is in the process of de-leveraging, Direxion is coming out with eight ETFs that offer even more leverage. Previously, if you wanted to add leverage to your portfolio you could invest in an ETF from ProShares or Rydex that offer twice the daily performance of each index. Now you can get three times the daily performance.

The eight ETFs include:

Direxion Large Cap Bull 3x (BGU)

Direxion Small Cap Bull 3x (TNA)

Direxion Energy Bull 3x (ERX)

Direxion Financial Bull 3x (FAS)

Direxion Large Cap Bear 3x (BGZ)

Direxion Small Cap Bear 3x (TZA)

Direxion Energy Bear 3x (ERY)

Direxion Financial Bear 3x (FAZ)

The eight ETFs include:

Direxion Large Cap Bull 3x (BGU)

Direxion Small Cap Bull 3x (TNA)

Direxion Energy Bull 3x (ERX)

Direxion Financial Bull 3x (FAS)

Direxion Large Cap Bear 3x (BGZ)

Direxion Small Cap Bear 3x (TZA)

Direxion Energy Bear 3x (ERY)

Direxion Financial Bear 3x (FAZ)

Saturday, November 1, 2008

What a Month...

Not the greatest month in the markets. The S&P was down 16.8% while the MS EAFE was down 20.2%.

It wasn't so bad for those of us following The Absolute Investor Model portfolios. Here are the portfolio returns for the month:

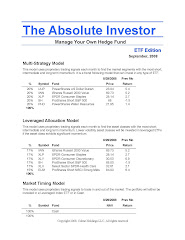

Mutual Fund Portfolios

Fund of Funds Model -0.5

Market Timing Model 0.0

S&P 500 -16.8

ETF Portfolios

Multi-Strategy Model 3.4

Leveraged Allocation Model 1.5

Market Timing Model 0.0

S&P 500 -16.8

Stock Portfolio

Long-Short Model 9.6

S&P 500 -16.8

It wasn't so bad for those of us following The Absolute Investor Model portfolios. Here are the portfolio returns for the month:

Mutual Fund Portfolios

Fund of Funds Model -0.5

Market Timing Model 0.0

S&P 500 -16.8

ETF Portfolios

Multi-Strategy Model 3.4

Leveraged Allocation Model 1.5

Market Timing Model 0.0

S&P 500 -16.8

Stock Portfolio

Long-Short Model 9.6

S&P 500 -16.8

Subscribe to:

Comments (Atom)